Option intrinsic value calculator

Underlying Price - The underlying symbol price Highest. At this point the option value is equal to the intrinsic value.

The Ultimate Guide To Option Moneyness Itm Otm Atm

Options Time Value Free Excel Calculator Use this free tool to calculate the time value and intrinsic value of any option in stock market trading.

/dotdash_Final_Extrinsic_Value_Curve_Apr_2020-01-010f32375f534dd78b2b8af044b8e65d.jpg)

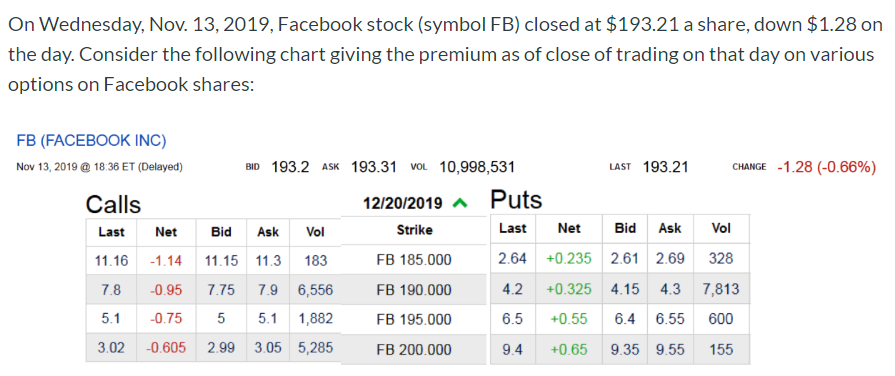

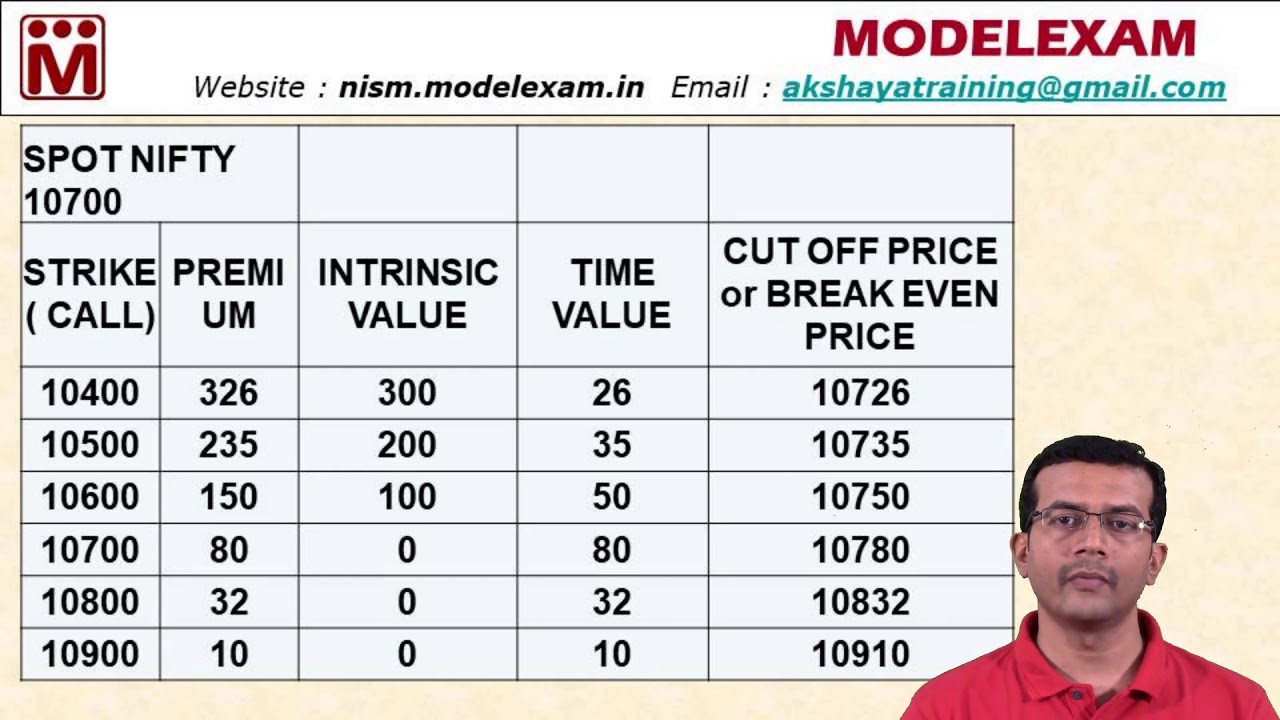

. You simply take the difference between the stocks current price and the options strike price then multiply by the number of shares your. This tool can be used by traders while trading index options Nifty options or stock options. The intrinsic value of the put option would be calculated by taking the 20 strike price and subtracting the 16 stock price or 4 in-the-money.

For Call option Intrinsic value Current price of underlying - Strike Price For Put Option Intrinsic value Strike Price - Current price of underlying For example you hold a. Calculating intrinsic value is easy. If the market price is below the strike price then the call option has zero intrinsic value.

Calculating intrinsic value of call options Call intrinsic value MAX of stock price less strike price OR zero Calculating intrinsic value of put options Put intrinsic value MAX of strike. This can also be used to simulate the outcomes of prices of the options in case of change in factors. The strike is 47 in this case and Bank of America.

RGV Intrinsic Value Intrinsic Value In finance company and its stocks are valued in terms of different values. Intrinsic value is a fundamental objective value that is based on the companys financials such as revenue net income cash debt etc. For put options intrinsic value is calculated as strike price minus underlying price the opposite of call option intrinsic value.

Options Intrinsic Value Pricing Calculator Instructions Input values to create a table of expiration prices for Calls and Puts. If the intrinsic value of the option. Option value calculator Calculate your options value.

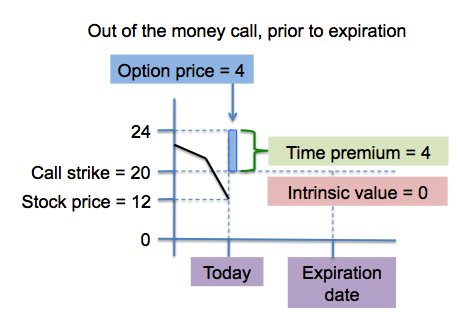

It can be calculated by dividing stocks intrinsicvalue by its current price. The extrinsic value is the portion of the option that is subject to theta decay. Intrinsic value Underlying Stocks Current Price - Call.

Intrinsic value CF1 1 r1 CF2 1 r2 CF3 1 r3. Extrinsic Value Calculator Use this tool to help calculate the extrinsic value on an option youre holding. Where market price tells you the price other people.

Look at the formula below. If the result is negative intrinsic value is zero. For a put option the intrinsic value is the strike price minus the underlying price.

A put options intrinsic value is the amount by which the puts strike price is higher than the current market price of the underlying stock. Underlying Price 0 100000 Strike Price 0 100000 Volatility 0 250 Interest Rate 0 10 Dividend Yield 0 20. How to Calculate the Intrinsic Value of a Stock Intrinsic Value Calculation Formula Intrinsic Value FV0 1d0 FV1 1d1 FV2 1d2 FVn 1dp FVx Net.

Following is the formula by which you can calculate the intrinsic value by using discounted cash flow analysis DCF. Intrinsic value also works the same way for a put option. For example a GE 30 put option would have an intrinsic value of zero 30 - 3480 -480 because the intrinsic value.

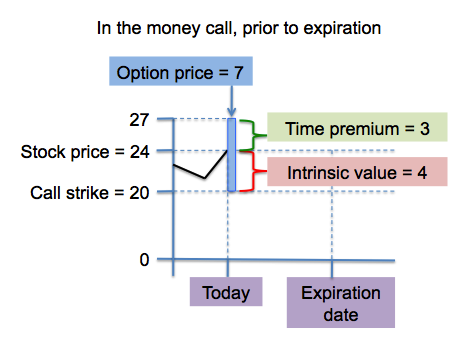

Option Value Intrinsic Value Time Value. Options Intrinsic Value Calculator helps caculating the Intrinsic Value of a Call Option or Put. When an option contract expires the time value would be zero.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

Time Premium In Options

Option Pricing The Intrinsic And Time Values Of Options Explained

The Options Industry Council Oic Options Pricing

Solved 3 What Is The Formula For The Intrinsic Value Of A Chegg Com

Extrinsic Value Of An Option Definition Examples How It Works

Options Time Value Free Excel Calculator Options Time Intrinsic Value Youtube

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

What Is Intrinsic Value In Option Derivative Market Quora

Time Premium In Options

What Is The Intrinsic Value In Option Trading Quora

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

How To Calculate Time Value Intrinsic Value Cut Off Price Of An Option Youtube

/dotdash_Final_Extrinsic_Value_Curve_Apr_2020-01-010f32375f534dd78b2b8af044b8e65d.jpg)

Time Value Definition

How To Calculate Time Value Intrinsic Value Premium Of An Option Youtube

Newsletter July 2019 Long Call Option With Negative Time Value Mathfinance

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation